You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Turnover test - 5th Grant

- Thread starter FreeD

- Start date

I would say yes as they are taxable and need to be declared In April 2020-21 tax return.

are HMRC going to base 5th grant on April 2020-21 tax return or April 19-April 2020 ? Not everyone will have their tax return done this April. Maybe that will be a stipulation too?

the 4th grant won’t be available till late April apparently so will that be declared in next years books 2021-2022 ? Despite it covering February, March of tax year 2020-2021

are HMRC going to base 5th grant on April 2020-21 tax return or April 19-April 2020 ? Not everyone will have their tax return done this April. Maybe that will be a stipulation too?

the 4th grant won’t be available till late April apparently so will that be declared in next years books 2021-2022 ? Despite it covering February, March of tax year 2020-2021

smoother09

Well-Known Member

Will this affect my dole money?

Your right ther. 700 hundred thousand out of work. They will be in work soon on the fraud side whith hmrc! HaGood luck to you all that claim it.

But i would be very careful.

I presume its because it becomes part of your income even though you haven't worked for it.Not sure how a grant can count towards turnover even tho its taxable...

smedhead

Active Member

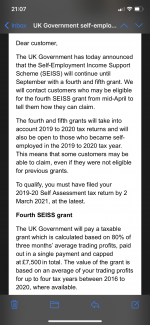

Dear customer, The UK Government has today announced that the Self-Employment Income Support Scheme (SEISS) will continue until September with a fourth and fifth grant. We will contact customers who may be eligible for the fourth SEISS grant from mid-April to tell them how they can claim. The fourth and fifth grants will take into account 2019 to 2020 tax returns and will also be open to those who became self-employed in the 2019 to 2020 tax year. This means that some customers may be able to claim, even if they were not eligible for previous grants. To qualify, you must have filed your 2019-20 Self Assessment tax return by 2 March 2021, at the latest. Fourth SEISS grant The UK Government will pay a taxable grant which is calculated based on 80% of three months’ average trading profits, paid out in a single payment and capped at £7,500 in total. The value of the grant is based on an average of your trading profits for up to four tax years between 2016 to 2020, where available. The grant will be available to claim by late April. As with previous grants, trading profits must be no more than £50,000 and at least equal to non-trading income in order to claim the fourth SEISS grant. Eligibility for the fourth SEISS grant will depend on whether you experienced a significant financial impact from coronavirus between February 2021 and April 2021. HMRC will take into account your 2019-20 return when assessing your eligibility for the scheme. This may also affect the amount of the fourth grant, which could be higher or lower than previous grants you have received. For this period, you will need to make an honest assessment that there has been a significant reduction in trading profits due to reduced demand or your inability to trade. If you make a claim, you will need to keep appropriate records as evidence. For further details of the changes to eligibility and calculation of the grant, please visit GOV.UK and search 'Self-Employment Income Support Scheme'. What happens next HMRC will contact you from mid-April if we believe you may be eligible for the fourth SEISS grant to tell you how you can claim. You will be provided with your personal claim date, which will be the earliest date you can submit a claim for the fourth SEISS grant. Claims for the fourth SEISS grant must be made by 31 May 2021, at the latest. The UK Government has also announced that there will be a fifth and final SEISS grant, covering the period between May and September, which you will be able to claim from late July if you are eligible. The amount of the fifth grant will be determined by how much your turnover has been reduced. The grant will be worth 80% of three months’ average trading profits, capped at £7,500, for those with a higher reduction in turnover (30% or more). For those with a lower reduction in turnover, of less than 30%, the grant will be worth 30% of three months’ average trading profits. Further details will be provided on the fifth grant in due course. Protect yourself from scams As part of the Budget, the Chancellor today announced a Taxpayer Protection Taskforce to tackle the minority who deliberately claim money they’re not entitled to. If you suspect fraud, please report it using our online form. Go to GOV.UK and search 'Report fraud to HMRC' for more information. Stay vigilant about scams, which may mimic government messages as a way of appearing authentic. Search 'scams' on GOV.UK for information on how to recognise genuine HMRC contact. You can forward suspicious emails claiming to be from HMRC to [email protected] and texts to 60599. Access the National Cyber Security Centre’s guide on how to stay secure online and protect yourself and your business against cyber crime by searching 'Cyber Aware' on GOV.UK. Yours faithfully

Jim Harra Bit more of the information! |

If they pay out in cash, I'll knock off 15% the amount.Will this affect my dole money?

Bet a few will claim it and try not to declare it.be careful that the gov.payment won't push you into the higher tax bracket.

Bet a few will claim it and try not to declare it.

it is paid into their bank accounts making it difficult to hide.

Extension wont pay for itself.

FreeD

Private Member

Extension wont pay for itself.

Yes but you will soon have nothing and be happy!

John j

Mono Don

I.m torn ........very much sticking at min.

Pussy.....go big or go home!I.m torn ........very much sticking at min.

algeeman

It’s A Boy

I wouldn't touch these two with a bargepole

take it

another £15000

pay the 40% on it

youl still have 9k

Complete

Well-Known Member

No chancetake it

another £15000

pay the 40% on it

youl still have 9k

algeeman

It’s A Boy

Zombie will be alright be allowed to flee the country before they investigate Z's

But algee's buggered

I was buggered from day 1 mate

tapit

Well-Known Member

It's ok we still have 4 refuse bins.Bunch of benefit cheats collectively helping to cripple the economy in my opinion

Wayners

Well-Known Member

I never claimed 3rd grant.. If your working flat out and your paying money in the bank plus buying materials and claiming against business plus other bill like van and fuel, mortgage being paid and you claim just to trouser cash and they come knocking you need to defend yourself with facts and figures. I was flat out from October until now and still got work lined up.

It's up to each person to decide if they are down on money and need to claim to live and cover bills.

Next grant covers from Feb - April I think so come April when you can put in for money, then you should be down on money with debts lined up ready to pay because you could not work as normal for whatever reason. You know what you normally earn so compare. I think when the dust settles its possible they will come knocking for the obvious ones that took the pxxx. Jmo

It's up to each person to decide if they are down on money and need to claim to live and cover bills.

Next grant covers from Feb - April I think so come April when you can put in for money, then you should be down on money with debts lined up ready to pay because you could not work as normal for whatever reason. You know what you normally earn so compare. I think when the dust settles its possible they will come knocking for the obvious ones that took the pxxx. Jmo

Olican

Private Member

algeeman

It’s A Boy

Bunch of benefit cheats collectively helping to cripple the economy in my opinion

next 2 claims are on the following years earnings

hopefully we'll get another eat and drink out thing again 50%

just wish I kept receipts for last eat out help out

Dollar

Well-Known Member

PmslBunch of benefit cheats collectively helping to cripple the economy in my opinion

So let’s take away all your rights & put good business out of business

Keep you under house arrest, take away customers take away materials for those still in business

make you wear a nappie ,blackmail a vaccine & you still believe For the greater of mankind

Absolutely brainwashing @ it’s finest

your welcome

A clean brain is better than no brain.Pmsl

So let’s take away all your rights & put good business out of business

Keep you under house arrest, take away customers take away materials for those still in business

make you wear a nappie ,blackmail a vaccine & you still believe For the greater of mankind

Absolutely brainwashing @ it’s finest

your welcome

tapit

Well-Known Member

Any country that has enough wealth to provide each household with 4 bins is doing alright Algernon.You lost me there Tony

stuart23

Private Member

Shut up you fking moon unit, most of the folk claiming these grants haven’t missed a day of work or very few if they have, just seeing it as free money. Go on and collect your free cash but don’t come moaning on here once it’s all to get paid back.Pmsl

So let’s take away all your rights & put good business out of business

Keep you under house arrest, take away customers take away materials for those still in business

make you wear a nappie ,blackmail a vaccine & you still believe For the greater of mankind

Absolutely brainwashing @ it’s finest

your welcome